Registering a partnership company in India provides entrepreneurs and small businesses a flexible and legally recognised structure to conduct joint business operations. A partnership firm allows two or more individuals to pool resources, share responsibilities, and manage business operations collectively while enjoying legal protection under Indian law.

Formal partnership firm registration in India ensures compliance with statutory requirements and enhances credibility with clients, financial institutions, and government authorities. Entrepreneurs can also choose partnership firm registration online India to complete the process conveniently and efficiently.

This structure is particularly suitable for small businesses, professionals, and startups who prefer shared responsibilities, cost-effective compliance, and operational flexibility. By registering a partnership firm, business owners gain legal recognition, protection against disputes, and the ability to access financial and operational benefits that unregistered firms may not enjoy.

Understanding Partnership Company Registration in India

A partnership firm is a business entity where partners agree to share profits, losses, and management responsibilities. While partnerships can operate informally, registration under the Indian Partnership Act, 1932, provides legal recognition and safeguards the rights of all partners.

Through partnership business registration, a firm can:

- Open a bank account in the firm’s name.

- Enter into legal contracts and agreements.

- Gain credibility when applying for loans, grants, or government approvals.

Partnership deed registration in India establishes a legally enforceable document that outlines each partner’s responsibilities, capital contribution, and profit-sharing ratios. This document ensures transparency, prevents disputes, and fosters trust among partners.

Registered partnership firms are also better positioned to grow and transition into more structured entities like LLPs or Private Limited Companies, if required.

Advantages of Partnership Firm Registration

Registering a partnership firm offers several key advantages:

- Legal Recognition: A registered firm is legally recognised and can operate under a separate identity from the partners.

- Defined Roles and Responsibilities: The partnership deed specifies partners’ duties, capital contribution, and profit-sharing arrangements.

- Enhanced Credibility: Registered firms earn trust with banks, investors, clients, and government authorities.

- Operational Flexibility: Partners can jointly manage business decisions while maintaining a simple governance structure.

- Dispute Prevention: A formal partnership deed provides a clear framework for resolving conflicts and preventing misunderstandings.

- Access to Funding: Registered firms can more easily apply for bank loans, credit facilities, or government schemes.

- Cost-Effective Compliance: Compared to other corporate structures, partnership firms have relatively low compliance requirements and fees.

These advantages make partnership firms a popular choice for small businesses, consultancy firms, and professional services seeking an easy-to-manage legal structure.

Step-by-Step Partnership Firm Registration Process in India

The partnership firm registration process typically involves the following steps:

- Drafting a Partnership Deed – Prepare a legal document defining partners’ roles, capital contributions, profit-sharing ratios, and operational responsibilities.

- Partner Identity Proof – Collect PAN cards, Aadhaar, or Passport copies for all partners.

- Registered Office Proof – Submit documents proving the official business address, such as utility bills or rental agreements.

- Submission to Registrar of Firms – File the partnership deed and application forms with the state Registrar.

- Certificate of Registration – After verification, the Registrar issues the Certificate of Registration, confirming the legal existence of the firm.

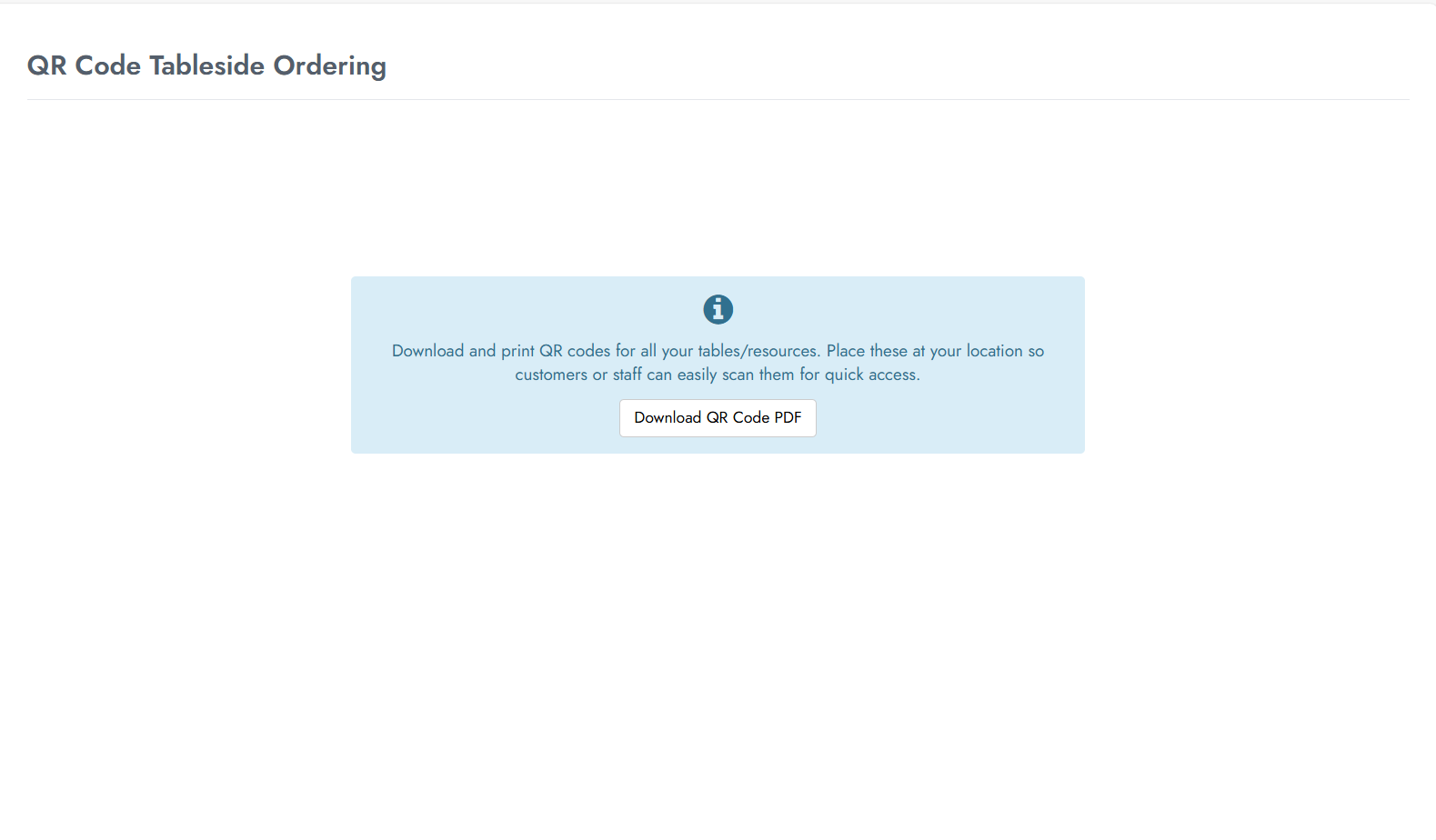

Entrepreneurs can opt for partnership firm registration online India, which speeds up the process, reduces paperwork, and allows tracking of application status digitally. Offline registration is also available but involves physical submission of documents, which can be more time-consuming.

Essential Documents for Partnership Firm Registration

The key documents required for registration include:

- Identity and address proofs of all partners (PAN, Aadhaar, Passport, or Voter ID)

- Proof of registered office (utility bill, lease agreement, or ownership documents)

- Partnership Deed signed by all partners

- Application forms for registration with the Registrar of Firms

Having complete and accurate documentation ensures a smoother registration process and prevents delays or rejection.

Partnership Deed Registration Fees in India

The partnership deed registration fees in India vary depending on the state and authorised capital of the firm. Typically, fees range from ₹1,000 to ₹5,000. Additional costs may include notary or professional charges if legal services are used.

Online registration options for partnership firm registration online India allow fee payments digitally, making the process faster, transparent, and convenient for entrepreneurs.

Compliance After Partnership Firm Registration

Once registered, partnership firms must adhere to specific compliance requirements:

- Maintaining Books of Accounts: Accurate records of all financial transactions must be maintained.

- Tax Filing: Submit income tax returns, GST returns (if applicable), and other statutory filings.

- Partner Meetings: Conduct regular meetings to discuss business operations, financial decisions, and strategic planning, keeping proper minutes.

- Adherence to Partnership Deed: Any changes, such as the admission, retirement, or exit of partners, must follow the terms of the partnership deed.

Proper compliance ensures the firm remains legally protected, avoids penalties, and maintains credibility with stakeholders.

Differences Between Partnership, LLP, and Private Limited Company

Choosing the right business structure is crucial for long-term success. A partnership firm is simple to set up and ideal for small businesses or professional services. However, partners have unlimited liability, meaning their personal assets may be used to meet business obligations.

In contrast, a Limited Liability Partnership (LLP) provides a separate legal entity where partners enjoy limited liability protection, making it suitable for startups and medium-sized businesses that want operational flexibility without risking personal assets.

A Private Limited Company also enjoys limited liability and a separate legal identity, but it involves stricter compliance and regulatory requirements. It is better suited for medium to large businesses seeking easier access to funding, investment, and scalability.

Understanding these differences allows entrepreneurs to select the business structure that aligns with their risk appetite, growth goals, and compliance capabilities.

MHCO – Legal Support for Partnership Firm Registration

MHCO is a leading law firm in India with extensive experience in partnership firm registration India and corporate legal advisory. Their team assists clients with partnership deed registration in India, drafting legal documents, submissions to the Registrar of Firms, and statutory compliance management. MHCO also provides guidance for partnership business registration and setting up a company in India, ensuring entrepreneurs navigate regulatory requirements efficiently and securely.

.jpg)

.jpg)